Stevia is a sugar substitute made from the leaves of the Stevia rebaudiana plant.

Stevia has gained popularity as a natural sugar substitute. Stevia is about 200 to 400 times sweeter than table sugar and is a non-nutritive sweetener, which means it has no carbohydrates, calories, or artificial ingredients.

Growing consumer interest in sugar-free diets, driven by a desire for healthier lifestyles, fuels the growing importance of stevia products. The surge in demand for plant-based, organic, and natural sweeteners is contributing to the popularity of stevia as a means to lower blood sugar levels.

In this Stevia market 2024 analysis, we will be discussing:

- Current State of the Stevia Market

- Health and Wellness Trends Driving Stevia Consumption

- Stevia Products and Applications

- Global Stevia Production and Supply Chain

- Consumer Preferences and Market Behavior

- Regulatory Environment and Stevia

- Stevia Market Key Players

Current State of the Stevia Market

The global stevia market is experiencing growth, with increasing consumer preferences for sugar-free alternatives and a focus on healthier living. The rising demand for plant-based, organic sweeteners further boosts the market. Key players in the industry are expanding product offerings to meet the growing global demand, with a promising future for the Stevia market.

According to Mordor Intelligence, the Stevia market size is estimated at USD 0.84 billion in 2024 and is expected to reach USD 1.36 billion by 2029, growing at a CAGR of 10.12% during the forecast period (2024-2029).

The stevia market value is expected to grow to US$1.3 billion in 2027 at a CAGR of 12.1%. By 2024, the market volume for Stevia used in beverages is expected to reach 479 tons.

Health and Wellness Trends Driving Stevia Consumption

As consumers become more mindful of their health, the demand for zero-calorie and naturally derived sweeteners has dramatically grown. Natural sweeteners are gaining market share over artificial sweeteners due to rising demand for natural foods. The wellness market worldwide will grow to almost US$7 trillion by 2025. The global wellness tourism industry will be worth around US$ 1.02 trillion in 2030.

With a negligible impact on blood sugar levels and zero calories, stevia offers an attractive alternative to traditional sugar and artificial sweeteners. The rising demand for vegan food, plant-based alternatives, and natural sweeteners are the driving factors for stevia.

According to Future Market Insights, the global low-calorie sweetener market is expected to reach a valuation of US$ 46 billion by 2032. The growth of the low-calorie sweeteners market is attributed to the rising preference for a healthy alternative to regular sweeteners or sugars. Stevia manufacturers are focusing on the production of low-calorie or sugar-free drinks and foods, which are mostly consumed among diabetics, obese, and people with high cholesterol.

Stevia Products and Applications

Stevia presents an attractive alternative for replacing sugar in food and beverages. Stevia can replace some or all of the sweetness of sugar or other sweeteners without compromising taste.

- Beverages: Its application ranges from soft drinks and fruit juices to teas and coffee, providing a healthier alternative to traditional sugar without compromising sweetness.

- Baked Goods: Stevia is a sugar substitute in baked goods, maintaining sweetness in cakes, cookies, and pastries. Its heat stability makes it suitable for baking, enabling lower-calorie and diabetic-friendly treats.

- Condiments & Sauces: It is commonly used in ketchup, barbecue sauces, and dressings, providing a healthier option and a balanced flavor profile without the added calories.

- Confections: The confectionery market trends indicate that creating sweets with reduced sugar content has become imperative due to changing consumer preferences. Thus, Stevia can help maintain its sweetness while appealing to health-conscious consumers, promoting guilt-free indulgence.

- Dairy Products: Stevia’s sweetening properties are applied to dairy products like yogurts and ice creams, providing diabetic-friendly and low-calorie options in the dairy aisle.

- Tabletop Sweeteners: Packaged in small quantities, they allow individuals to customize the sweetness of their food and beverages without the need for traditional sugar.

- Personal Care: Stevia’s applications extend to personal care products with desired sweetness, such as toothpaste and mouthwashes. It serves as a natural sweetening agent, contributing to a pleasant taste while avoiding the drawbacks associated with artificial sweeteners.

Global Stevia Production and Supply Chain

Stevia production involves cultivating the Stevia rebaudiana plant, harvesting its leaves, and extracting steviol glycosides, the sweet compounds. After drying and processing, the extract undergoes purification to meet quality standards. The supply chain integrates farmers, processors, manufacturers, and distributors.

Most stevia suppliers come from Paraguay, Kenya, China, the United States, and many other parts of the world, including Vietnam, Brazil, India, Argentina, and Colombia. With wide adaptability from the lowlands to the highlands and temperature tolerance between -6 o C to 43 o C.

Stevia’s popularity drives demand, with a strong supply chain to ensure consistent availability. Sustainable cultivation practices and efficient processing contribute to the quality and reliability of the stevia supply chain.

Stevia’s production and supply chain face certain challenges, such as weather-related risks impacting crop yields and requiring resilient cultivation methods. Sustainable farming practices present a chance for environmentally friendly production. Continuous research into refining cultivation techniques, leveraging urban farming, and optimizing resource use provides opportunities for improved efficiency and cost-effectiveness in stevia production.

Consumer Preferences and Market Behavior

According to NielsenIQ Product Insight, the number of UPCs (Unit Product Code) in Food and beverage that would qualify to contain HFCS (a certain type of sweetener) has declined over 8% compared to 2 years ago (compared to a 4% decline in UPCs that are free from HFCS).

Responding to consumer health concerns, food and beverage manufacturers are reducing sweeteners from fruit juice beverages and other items. Artificial sweeteners are perceived as beneficial or detrimental to health, depending on individual wellness preferences. 72% of consumers express active efforts to restrict or completely avoid sugars. Currently, 56% of U.S. food and beverage offerings exclude artificial sweeteners. Therefore, the stevia industry is reshaping these perceptions for F&B manufacturers and providing a unique way to address changing consumer preferences and market behavior.

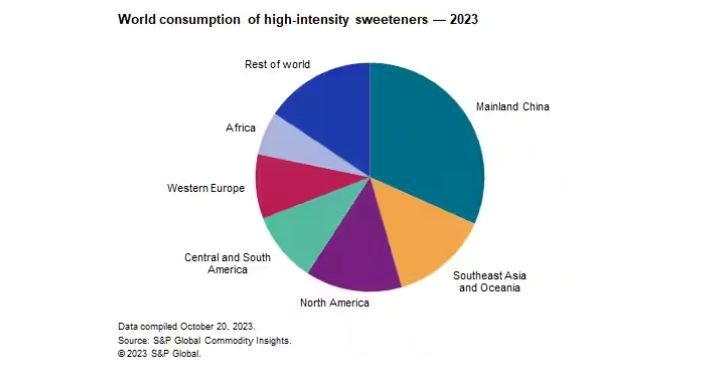

According to S&P Global, beverages comprise most of the world’s High-Intensity Sugar (HIS) consumption; other important end uses include food, tabletop sweeteners, personal care products (mainly toothpaste and mouthwash), and pharmaceuticals.

Source: S&P Globa

The global high-intensity sweetener (HIS) market exhibits diverse regional trends from 2023 to 28. While mature sweeteners like cyclamate witness increased demand in Asia and Africa, others like saccharin and aspartame decline in various regions. Acesulfame K, sucralose, and stevia extract show growing popularity worldwide, especially sucralose. Natural HIS, led by Stevia and Monk Fruit, sees above-average growth due to consumer preferences, though its market share remains relatively small. Continued demand is expected with improved-tasting next-generation stevia sweeteners.

According to the US Sugars and Alternative Sweeteners Market report published on Mintel, 86% of consumers report paying attention to sugar consumption. Younger men are most likely to report maximum consumption, while those 55+ are most likely to under-index; Millennials are most likely to report overconsumption.

Perspectives on sugars and sweeteners differ, shaped by information from media to healthcare experts. Consumers need assistance understanding this information and identifying optimal products for their preferences and uses.

Regulatory Environment and Stevia

Regulatory requirements for stevia involve assessing its safety and quality. In the United States, the FDA granted Generally Recognized as Safe (GRAS) status to specific steviol glycosides. The EU approved steviol glycosides as a food additive. However, regulations vary for each regional market, with some countries restricting stevia’s use. Manufacturers must comply with regional regulatory frameworks, ensuring approvals and adherence to permissible limits for stevia in food and beverage products.

Food and beverage manufacturers using Stevia in their products must meet standards set by regulatory bodies like the FDA and EU, obtaining approvals for recognized status and certification for production. Certification processes, such as organic or non-GMO certifications, further validate product quality.

Stevia Market Key Players

The present stevia companies in the industry are highly consolidated, contributing significantly through substantial investments in research and development. These key players focus on crafting cutting-edge, inventive, and distinctive products to meet to end-users needs. They focus on delivering top-notch, standardized, and environmentally sustainable consumer offerings.

The key players include:

- Cargill Incorporated

- Ingredion Incorporated

- Koninklijke DSM NV

- Tate and Lyle Plc.

- Sunwin Stevia International, Inc.

- GLG Life Tech Corp

- Evolva Holding SA Nemours & Co

- Archer Daniels Midland Company

- Stevia Nutra Corp.

These key players in the stevia market are implementing strategies such as market expansion, collaborations, agreements, partnerships, product launches, and mergers to broaden their reach. They are taking initiatives to promote their brands by raising awareness programs.

Conclusion

Stevia can be considered the best alternative to sugar and is cost-effective as it can be easily cultivated and preferred by consumers and food manufacturers.

With the increasing consumer preference for natural sweeteners, awareness of health concerns related to sugar consumption, and expanding product applications, Stevia is becoming increasingly popular in the food and beverage industry.

Consumers dominate the food and beverage products market with Stevia, depending on the regional markets, driving the growth of the stevia market. Asia-Pacific is the fastest-growing market for stevia products.

Looking forward, the market value of stevia is projected to increase further due to widescale application and growing demand.