The drinking habit scripts have flipped.

The global Wine market is segmented by color, notably red, rose, and white.

It has proven to be a crisis-proof market. Like broader food and beverage trends, consumers are increasingly interested in Wines, which received a significant boost even during the pandemic.

Although the Wine market has met a fair few challenges over the past few years, it has shown resilience and responsiveness.

While the economic downturn and rising inflation pressure consumers to cut back on discretionary spending, opportunities in the Wine industry evolve, particularly in the premium space, red Wines, and alternative Wines.

Global Wine Market Overview

According to Statistica, global wine market is projected to grow by 4.35% from 2024 to 2028 resulting in a market volume of US$215.7bn in the year 2028.

Even in the seventh consecutive year of increasing global Wine market sales, the indicator is estimated to reach 412.9 billion U.S. dollars and, therefore, a new peak in 2027.

During the pandemic, as digitization was on the rise and Wine companies turned to online platforms, the revenue in the Wine market worldwide was forecast to increase from approximately 4.77 billion U.S. dollars in 2017 to more than 14 billion U.S. dollars by 2027.

This was generated through e-commerce platforms as more consumers purchased online.

However, according to Statista, the Wine market size will decline in all segments in 2027 compared to the previous year. Comparing the three different segments for the year 2027, the segment ‘Sparkling Wine’ leads the ranking with 6.94 percent.

Contrastingly, ‘Still Wine’ is ranked last, with 4.95 percent. Their difference, compared to Sparkling Wine, lies at 1.99 percentage points.

Key Players and Market Share

The global Wine market is segmented by region, key players, and product type. Key players in the wine market have the upper hand in understanding the market and resources.

The key players in the Wine market are:

- E. & J. Gallo Winery

- The Wine Group LLC

- Constellation Brands Inc

- Treasury Wine Estates Ltd

- Accolade Wines

- Pernod Ricard

- Viña Concha Y Toro S.A.

- Bacardi Limited

- Slaviansky Rpk Zao

- Grupo Peñaflor S.A.

Italy, France, and Spain were the top three producers of wine worldwide as of 2022. That year, France produced about 45.6 million hectoliters of wine.

The wine market on a global scale is noteworthy for its exceptional diversity of wine-producing regions, each characterized by its individual climate, soil composition, and grape varieties.

These distinctive elements collectively shape the unique qualities and flavors of the wines crafted in these areas, resulting in a broad spectrum of wine styles that can satisfy various consumer tastes.

Wine market Worldwide is experiencing growth due to changing customer preferences, emerging trends in the market, unique local circumstances, and underlying macroeconomic factors.

Consumer Preferences and Trends

As the Wine industry trends evolve, wine enthusiasts are increasingly looking for new options, favoring wines with minimal additives and a focus on terroir.

As consumers become more knowledgeable about wine, they prioritize quality, transparency, and ethical production practices when making their selections.

The Top 10 Trends in Asia’s Food and Beverage Industry for 2024 indicate that the food and beverage industry is redefining how we enjoy drinks.

Let’s explore the emerging trends in the Wine industry.

Sustainable & Organic Wines

All around the world, consumers have become more conscious of eating sustainably and organically. Hence, it is one of the most prominent Wine trends affecting wine producers worldwide.

According to a survey conducted by McKinsey and Co., 60 percent of respondents said they’d pay more for a product with sustainable packaging. Consumers are shifting their spending toward products with ESG-related claims.

On the other hand, the natural Wines market is growing steadily as consumers become more conscious of what they eat and drink and seek out products that are produced in an environmentally friendly and sustainable manner.

As per the report published by The Brainy Insights, the global organic wine market is expected to reach USD 21.1 Billion by 2030, at a CAGR of 10.5% during the forecast period 2022-2030.

Organic or natural wines are grown without synthetic pesticides, herbicides, and genetically modified organisms (GMOs).

The organic wine demand is driven by a desire for more natural and authentic products, consumer education about what organic means, and increasing environmental concerns.

Convenient Wine Packaging

A heavy glass bottle is no longer the only option for your wine; with emerging food packaging technology, you can’t go wrong with something genuinely compostable and eco-friendly.

In recent years, the Wine industry has been exploring alternative sustainable packaging options that offer convenience, innovation, and, most importantly, for the ethical consumer – sustainability.

During the pandemic, canned wines gained popularity due to convenience, portability, and single-serving size, which suited the stay-at-home lifestyle.

Consumers appreciated their lower cost, reduced waste, and suitability for outdoor activities. This trend continues as people seek convenient and eco-friendly options for wine consumption.

As we move forward, it is evident that a revolution in wine packaging is underway, driven by climate change, technology, lifestyle changes, and increasing awareness of sustainability.

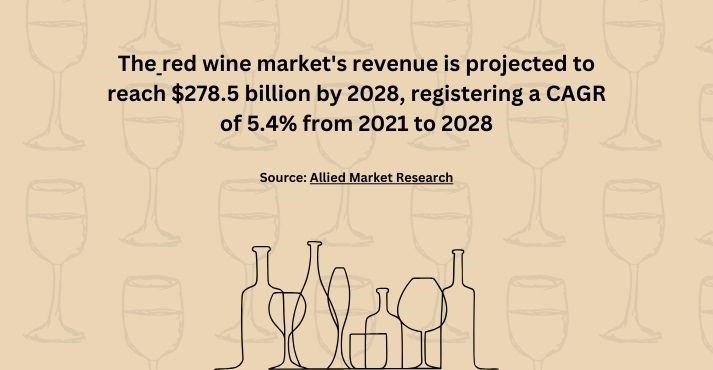

Red Wine Market Domination

Red wine is poised to maintain its global market dominance due to its timeless appeal, versatility, and growing demand.

According to Allied Market Research, the red wine market’s revenue is projected to reach $278.5 billion by 2028, registering a CAGR of 5.4% from 2021 to 2028.

The global Red Wine market size is segmented based on application, end user, and region, focusing on manufacturers in different regions.

Red wine’s adaptability to diverse cuisines and occasions and its expanding popularity in emerging markets positions it as a preferred choice, securing its dominant status in the global wine market.

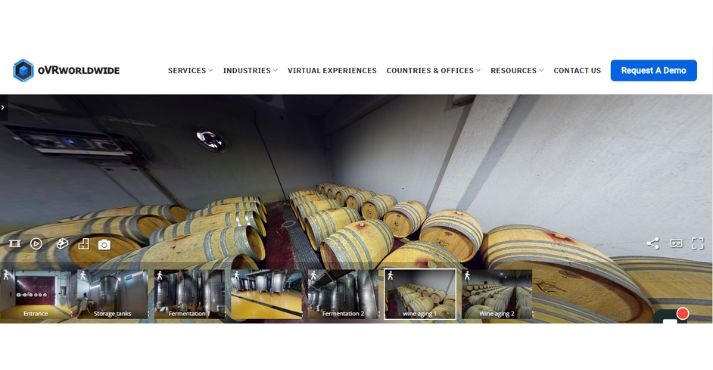

AR (Augmented Reality) in Vineyards

As the foodtech continues transforming the Wine industry’s growth, augmented reality brings wine to life.

Wine-producing companies are embracing AR technology to target consumers and make their labels alluring by showcasing the information uniquely.

AR takes consumers to the winery virtually through their smartphones, with a 3D video of the winery. It helps consumers explore the product quality, assess the winery practices, and ensure sustainability measures are followed, instigating them to make wine purchases.

Also, AR directs the consumers to retail stores, where they can shop through the virtual world and ask questions about the wine products by virtual sales assistant.

For example, below is an AR-based tour of Chateau Ka Winery, showcasing the production process of their award-winning wines, vineyard, and the art of winemaking. It enables customers to experience the winery’s beauty anywhere in the world.

Source: oVRworldwide

Wine Production and Distribution

As we explore the wine market, it is essential to understand the winemaking/production process as a whole. Integrating technology in production drives significant developments, enabling efficiency, accessibility, and sustainability.

Wine companies are integrating sensors and software to monitor climate vineyards, robots for harvesting and bottling, drones to suspect vines and artificial intelligence to refine the wine-making process.

Here’s a simple breakdown of the step-by-step process from wine to bottle.

- Harvest

- Crushing and pressing

- Fermentation

- Aging

- Bottling

Wine distribution is mainly invisible to the consumers but is an integral part of the wine supply chain.

Distribution channels and logistics play a crucial role in the wine industry, connecting wine producers (vineyards and wineries) with consumers and ensuring that wine reaches its intended market efficiently.

Here’s a list of distribution channels available for wine companies to avail:

- Wineries and Cellar Doors

- Restaurants and Bars

- Wine Distributors

- Wine Clubs

- Wine Auctions

- Specialty Wine Shops

- Direct-to-consumer (e.g., e-commerce, mailing lists)

- Wine Tasting Events

- Wine Festivals

- Wine Wholesalers

- Supermarkets

- Convenience Stores

Challenges and Opportunities

The wine industry landscape has been rapidly changing since the pandemic, and some companies have been perpetually uprooted from the deemed status quo.

To thrive, you must know the current challenges and opportunities to create goals tailored to ongoing changes.

Let’s look at the most common challenges that many wine businesses need to address:

- Climate change – Global warming poses an existential threat to vineyards, as fluctuating temperatures and rainfall patterns affect grape production and the actual quality of the wine.

- Regulatory issues – Complex labeling and geographical indication regulations, varying state and international laws, and strict compliance requirements increase operational costs and hinder market access.

- Rising inflation – Inflation weighs on all sectors and the wine sector. Worldwide wine sales drop amid the rising living costs.

- Growing competition – The competition is fierce in the wine industry, and consumers know the brand’s reputation and credibility. To succeed in this market, wine producers and distributors must focus on innovation, product differentiation, and building relationships with consumers.

Despite several challenges the wine industry faces, companies show resilience and overcome barriers.

The key opportunities will move the wine industry forward in the coming years.

- Export opportunities – Consider expanding your wine export to emerging markets like China, India, and Brazil, with a growing middle class and an increasing demand for high-quality wines.

- E-commerce – E-commerce platforms offer an excellent channel to sell wine directly to consumers. Host virtual wine tastings and events, leveraging technology to connect and educate customers.

- Integration of AR – Through AR, consumers can visit vineyards, understand the process, and look through the process.

Global Wine Market (FAQs)

Which region accounts for the largest share of the Wine market?

France, Italy, and Spain are still the leading Wine-producing and Wine-exporting countries. Other notable wine-producing regions include the United States, Australia, South Africa, Germany, Argentina, and Chile.

What is the leading product segment in the Wine market?

The leading product segment in the Wine market is primarily Still Wine, with the highest value of US$ 340.08 billion. The Still Wine is versatile and can be enjoyed independently or by exploring a unique wine food pairing, making it a popular choice among consumers.

What are the factors driving the Wine market?

The factors driving the Wine market include:

- Consumer preferences and evolving tastes

- Global Wine production and vineyard expansion

- Export and import trends

- Marketing and branding strategies

- Wine tourism and experiential consumption

- Regulatory changes and tariffs

- Sustainability and organic Wine production

- E-commerce and direct-to-consumer sales

- Emerging Wine regions

- Health and wellness trends

Closing Thoughts

From new technologies to new winemaking trends to the emergence of entirely new wine regions, there is much to look forward to over the next decade in the Wine market.

The wine industry statistics indicate that wine consumption continues to grow, driven by an increasing preference for premium and organic wines.

E-commerce has gained prominence as a sales channel, offering convenience to consumers. Sustainability and eco-friendly practices are becoming pivotal, reflecting consumers’ environmental concerns.

Adapting to these trends while navigating regulatory complexities is essential for wineries to thrive in this competitive industry.