Fresh food retained its positive performance in 2022 with retail volume driving growth thanks to healthy eating being a key motivator as the world emerges from the COVID-19 pandemic. Foodservice and institutional volumes are underperforming compared to pre-pandemic levels as hybrid working policies and China’s zero-Covid policy (in 2022) reduced out-of-home consumption. Global inflationary pressures also impacted consumers’ disposable income, reducing their spending on non-essentials. Moderate growth is expected for total volume over the forecast period with these five trends driving demand for fresh food.

Supply chain issues exacerbate fresh food inflation

Supply chain bottlenecks and energy shortages have increased prices with the situation being exacerbated by the ongoing war in Ukraine. Furthermore, adverse weather conditions and outbreaks of animal disease have reduced production, tightening global supply, which increases prices of eggs, meat and fruit, in particular.

Supply chain constraints have sparked innovative solutions from companies to continue to meet customer demand, including an increase in direct-to-consumer business models. In Thailand, Talaad Thai, one of the largest wholesalers in the ASEAN region, launched an online platform where consumers can buy directly from the wholesaler at more affordable wholesale prices and in bulk.

Localising supply chains to secure future stability

The global supply chain crisis highlighted the vulnerabilities of food supply and raised concerns of future global food security. Hence, increased domestic production is essential to ensure food security and align with the growing demand from consumers. In 2022, 27% of consumers try to purchase locally-sourced products and services, according to Euromonitor International’s Voice of the Consumer: Lifestyles Survey (fielded in January and February 2022, n=39,832).

Australian Eggs, a non-profit company specialising in marketing and R&D services in Australia, launched EggTrace in June 2022. This digital platform allows farmers to capture and store egg traceability information. As the global trend towards transparency and traceability in the food chain accelerates, it has become more important in ensuring consumer confidence and trust in local supply chains.

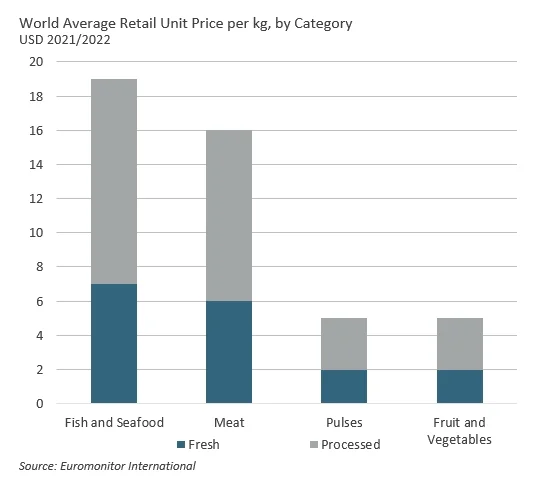

Increased competition between fresh and processed food

Consumers have resumed busier lifestyles since COVID-19-related lockdown restrictions were relaxed, which see consumers looking for affordable, time-saving alternatives like processed counterparts of fresh foods. Furthermore, due to processed foods’ longer shelf life, it has appeal through less food waste. Although competition between fresh foods and their processed equivalents is rising amid consumers’ need for convenience, fresh food’s competitive price points and nutritional profile advantages are clear. And the adoption of hybrid working practices across many countries means that the opportunities to cook at home – using fresh food – are still greater than pre-pandemic.

Addressing rising costs through sustainable production

The rising cost of energy further strengthened producers’ commitments to their sustainability goals as these can reduce their spend on electricity, gas, etc. A key priority for many is reducing packaging, which can be both environmentally-friendly and a cost-saving measure which appeals to ethically-minded consumers. According to Euromonitor International’s Voice of the Consumer: Lifestyles survey (fielded in January and February 2022, n=39,832), 66% of respondents are worried about climate change and try to have a positive impact on the environment in 2022. Use of alternative sources of energy and packaging reduction can therefore play a dual role in fresh food producers’ activity, allowing them to meet their sustainability commitments while helping them mitigate rising production costs.

Flexitarianism is driving demand for alternative sources of protein

Rising health and sustainability concerns have encouraged more consumers to reduce their meat consumption. This is confirmed in Euromonitor International’s Voice of the Consumer: Health and Nutrition Surveys 2019 and 2022, with the number of respondents claiming that they are trying to limit their meat intake having increased from 21% in 2019 to 23% in 2022. With health being the top reason consumers follow a flexitarian diet, poultry is expected to outperform other meat types as it is perceived as healthier in many markets (and is significantly cheaper than red meat). However, the overall interest in meat reduction is expected to create a massive increase in the demand for alternative sources of protein. Animal-based proteins that are perceived as more nutritious such as eggs and fish and seafood are expected to continue growing. The strongest increase, however, is projected to come from plant-based sources of protein, such as nuts and pulses with the latter further benefiting from their competitive price.

For more on these trends, plus detail on fresh food sales around the world, please see our report World Market for Fresh Food.

For more information, click here.