FHA Insider delves into the evolving landscape of alternative proteins in the global market, with a particular focus on Asia.

Despite a decline in demand for alternative proteins in the retail sector, the industry is anticipated to witness substantial growth, projected to surpass $290 billion by the year 2035. The increasing interest in alternative proteins within Asia, particularly in China, presents a significant opportunity for food manufacturers to capitalize on this emerging market.

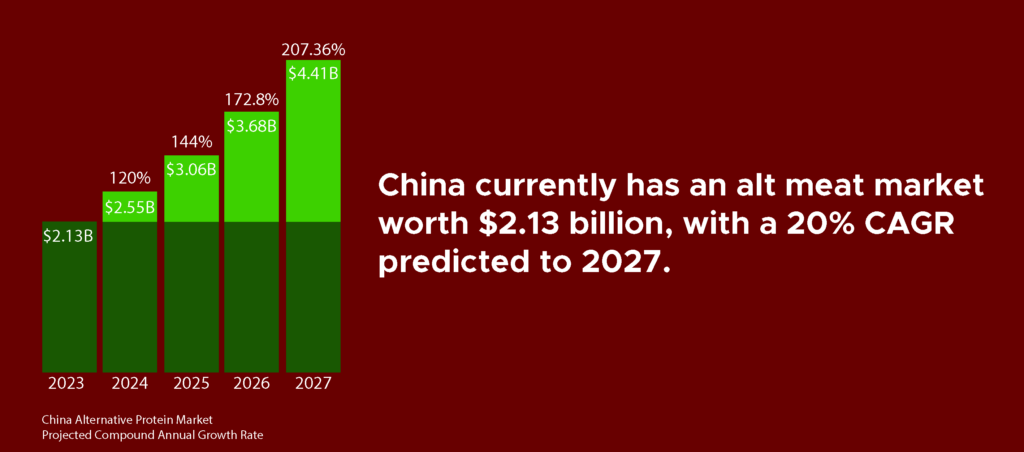

Insights from China’s Alternative Protein Market

China’s Alternative Protein Market Projection 2023 – 2027

China, being one of the largest and most influential markets in Asia, offers valuable insights into the dynamics of the alternative protein industry. According to industry experts, plant-based meat products are available through both offline and traditional retail outlets. However, sales performance is notably stronger in online outlets, primarily within the realm of e-commerce platforms.

The strategy employed by companies is to debut on e-commerce platforms before making their appearance in physical retail stores. This approach not only allows manufacturers to gauge market receptiveness but also helps in mitigating upfront costs.

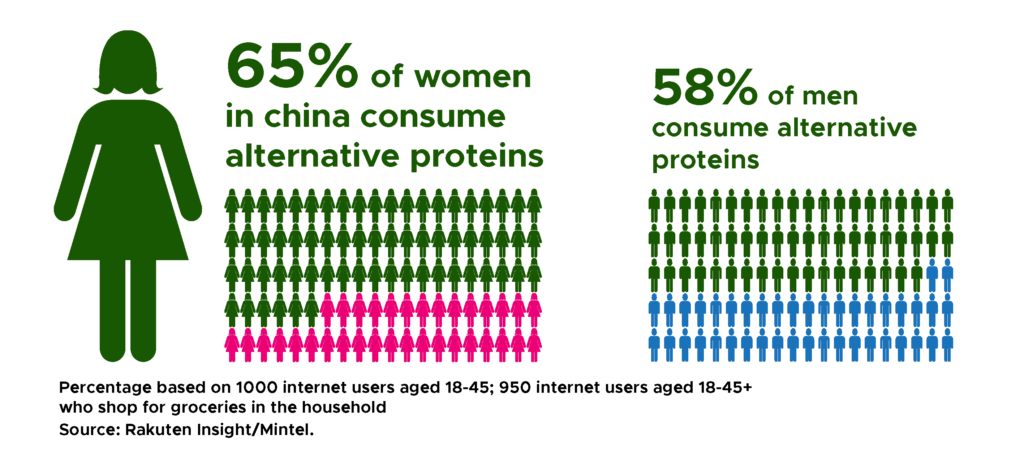

Gender Demographics

China’s plant-based meat consumption reveals interesting patterns of segmentation. A higher percentage of women than men in China choose plant-based meat products. Consumption of these products also tends to increase with age and household income. Moreover, a greater proportion of parents are consumers of plant-based meat compared to non-parents.

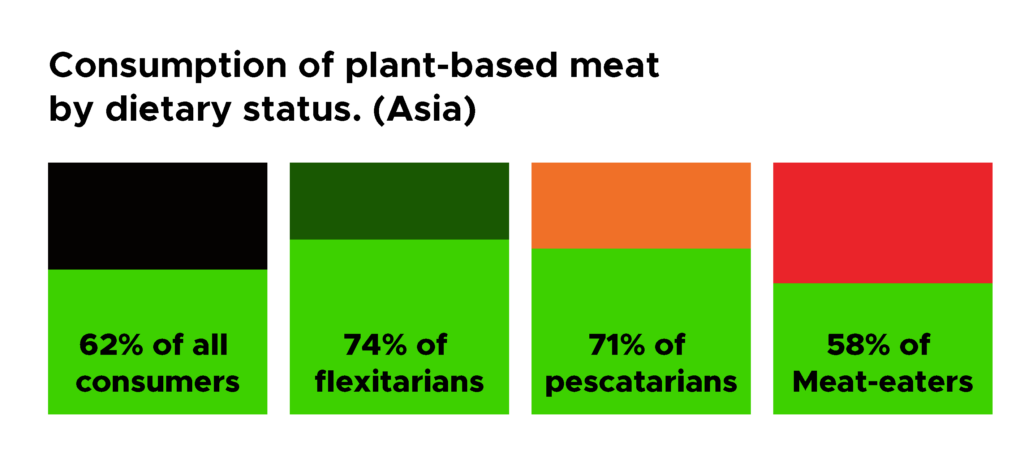

Flexitarians Driving Demand

Alternative Protein Consumption by Dietary Status

The rise of flexitarian diets, characterized by individuals incorporating plant-based options into some or most meals, is a pivotal factor propelling the interest in alternative proteins across the five focus markets. Among flexitarians, a remarkable 74% consume plant-based meat, compared to 58% among traditional meat-eaters who also indulge in plant-based alternatives.

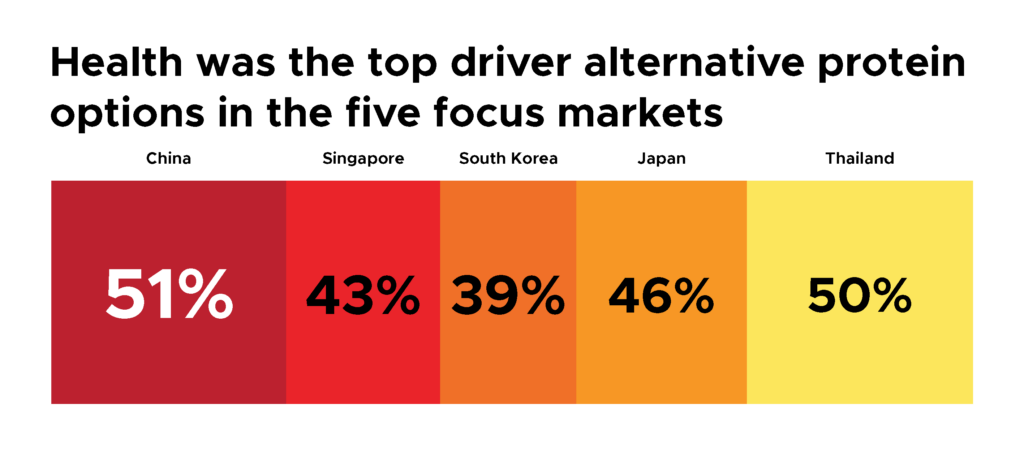

Health as the Main Driver

Top Alternative Protein Driver

Health considerations emerge as the primary motivation for consumers to embrace plant-based meat products. However, several perceived barriers impede widespread acceptance, the top three of which are taste, price, and the perception of excessive processing in plant-based meat products within the five focus Asian markets.

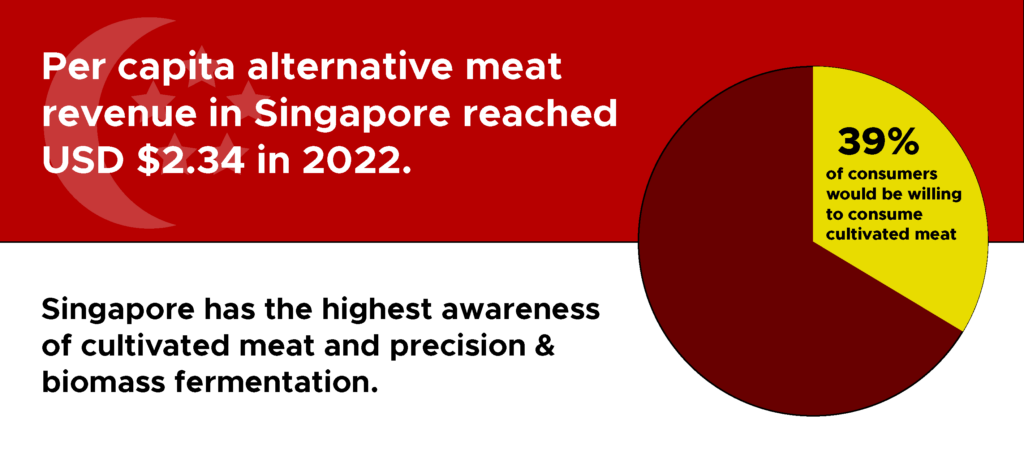

Singapore: A High-Per Capita Alternative Meat Revenue Market

Singapore stands out with a high per capita alternative meat revenue, reaching $2.34 last year. The city-state also showcases a substantial willingness among consumers to embrace cultivated meat, which is already available for purchase. Notably, awareness of advanced technologies like precision fermentation is higher in Singapore compared to other Asian countries.

Environmental Potential and Ongoing Advancements

Despite the promising advancements in alternative proteins and their potential to positively impact the global food system’s environmental footprint, it is crucial to acknowledge that the sector is still in its early stages. The findings from a UC Davis study underscore the need for continued research and development to fully unlock the transformative capabilities of alternative proteins.

The alternative protein industry’s bright future, projected to surpass $290 billion by 2035 in an article by Dai Magister, showcases significant potential despite recent retail trends. Asia, particularly China and Singapore, emerges as a promising market, offering food manufacturers a golden opportunity to capitalize on the region’s increasing interest in plant-based options. Understanding consumer preferences and addressing perceived barriers will be key to driving broader adoption of alternative proteins. As the industry matures and technological advancements continue, alternative proteins are likely to play a crucial role in fostering a more sustainable and health-conscious global food system.

References

Grylls, B. (2023, June 27). Alternative proteins: Market snapshot 2023. Food Manufacture. https://www.foodmanufacture.co.uk/Article/2023/06/27/Alternative-proteins-market-2023

(2023, July 12). Report Reveals the Five Asian Countries With the Greatest Alt Protein Market Potential. Vegeconomist. https://vegconomist.com/studies-and-numbers/asian-countries-alt-protein-market-potential

(2023, July). Alternative Proteins and Asia: 10 Key Findings. Food Frontier. https://www.foodfrontier.org/alternative-proteins-and-asia-ten-key-findings/

Want to expand your alternative protein business in Asia?

FHA – Food and Beverage returns next year on 23-26 April 2024 at Singapore Expo. With a line-up of leading global suppliers, industry professionals can anticipate the most extensive showcase of trending F&B and hospitality products and solutions, cutting-edge technologies for food & drinks manufacturing, and more at the mega event. Contact us to get involved.