During the recent A taste of trends: plant-based products in 2023 panel discussion for Food Matters Live, the question was posed: Is it vegans who are the main consumers of meat and dairy alternatives? Or is it people who are cutting down on their consumption of animal-based foods – meat and dairy limiters? Thanks to Euromonitor International’s Voice of the Consumer: Health and Nutrition survey, it is possible to determine the answer.

Two-thirds sometimes eat plant-based meat and/or dairy

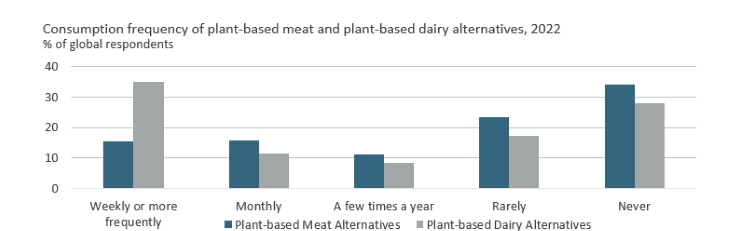

To begin with, we can see how often people are consuming plant-based meat and plant-based dairy alternatives.

consumption-frequency-of-plant-based-meat

Source: Euromonitor International’s Voice of the Consumer: Health and Nutrition survey. Fielded Jan-Feb 2022, n = 21,457

Plant-based dairy is more likely to be consumed frequently, thanks in large part to the standard daily use of milk (in hot drinks, at breakfast, as an ingredient, etc.). However, it is clear both types of alternatives have made significant inroads into consumers’ diets – only 34%/28% “never” eat plant-based meat and plant-based dairy alternatives respectively.

The alternative eaters

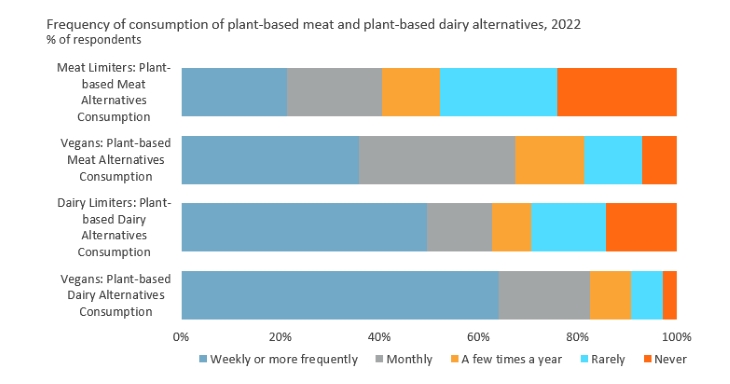

By utilising Euromonitor International’s Voice of the Consumer: Health and Nutrition survey, it is possible to determine how often vegans (people who do not eat meat, fish, dairy products, or eggs) consume plant-based meat and plant-based dairy alternatives.

It is also possible to see how often people who are “trying to limit [their] meat intake” consume plant-based meat alternatives, and how often people who are “trying to limit [their] intake of dairy” consume plant-based dairy alternatives.

frequency-of-consumption-of-plant-based-meals

Source: Euromonitor International’s Voice of the Consumer: Health and Nutrition survey. Fielded Jan-Feb 2022, n = 21,457

As can be seen, vegans are more likely than meat limiters to eat plant-based meat alternatives, and are more likely than dairy limiters to eat plant-based dairy alternatives. The standout result is that over six in 10 vegans report consuming plant-based dairy alternatives weekly or more frequently.

Not the whole story…

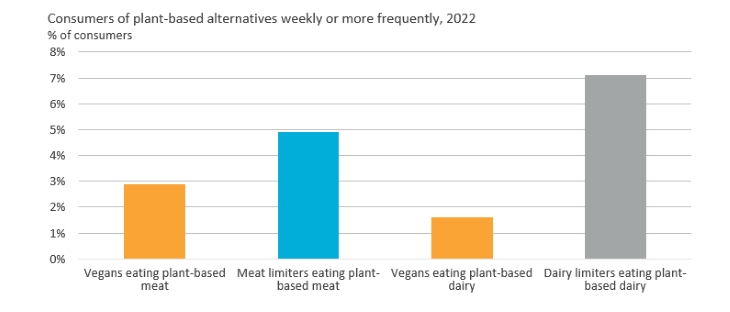

Although the above analysis reveals that vegans are more likely to eat plant-based meat or plant based-dairy alternatives, this does not take into account the fact that vegans are a significantly smaller group than those who are seeking to limit the amount of meat or of dairy that they eat.

Overall, 4.6% of people are vegan globally. Using cross analysis (i.e., vegans’ responses to Euromonitor International’s Voice of the Consumer: Health and Nutrition survey), we can determine that 64.1% consume plant-based dairy alternatives weekly or more frequently; this works out as 2.9% of consumers. 35.8% consume plant-based meat alternatives weekly or more frequently; this is 1.7% of consumers.

To apply the same methodology to consumers who are trying to limit the consumption of meat, and those who are trying to limit the consumption of dairy: there are 23.2% limiting meat and 14.4% limiting dairy. 21.3% of meat limiters consume plant-based meat alternatives weekly or more frequently, which works out as 4.9% of consumers. 49.5% of dairy limiters consume plant-based dairy alternatives weekly or more frequently, which is 7.1% of consumers.

Overall, then, it is limiters who are the key customers for plant-based dairy alternatives and plant-based meat alternatives – there are more of them consuming these products weekly (or more frequently) than there are vegans doing the same.

consumers-of-plant-based-alternatives

Source: Euromonitor International’s Voice of the Consumer: Health and Nutrition survey. Fielded Jan-Feb 2022, n = 21,457

…and meat limiters continue to grow

Of all the groups of consumers under consideration, the largest is the 23% globally who say they are trying to reduce/limit meat consumption. And the fact that this percentage has been creeping upwards over the last few years – now closer to one-in-four consumers than the one in five it was in 2019 – goes some way towards explaining why this remains a dynamic area of development in food and nutrition. Innovative NPDs are continuing to proliferate, and producers are increasing their offers, even as some of the larger players reconfigure their expectations away from the unrealistic growth expectations that were apparent pre-pandemic.

For more plant-based discussion, please see A taste of trends: plant-based products in 2023.

For Euromonitor’s latest report in the alternatives space, please see Cultured Meat and More – the Potential Shift from Farm to Lab

For more on the spread of plant-based alternatives beyond meat and dairy, please see the report The Evolution of Plant Based: Eating and Beyond

For more information, click here.

This excerpt was contributed by knowledge partner: